About

Us

We believe that open finance and open data will change the world.

Our mission is to combine deep expertise and standards compliant technology to shape and unlock that potential.

We have the open API technology and expertise to shape the open data economy. We enable the enablers to unlock the power of open finance and deliver real commercial growth, innovation and positive change in society. And we want to ensure this is built on strong foundations.

Our purpose is to provide solid foundations to unlock the power of open data and change the world.

The three founders of Ozone API helped create the open banking blueprint in the UK. Leading the development of the UK open banking standard and driving the development of the ecosystem.

We saw the huge potential, but also the difficulties faced by banks in doing it well. So we created Ozone API.

We know the standards space better than anyone and continue to shape the development of standards around the world.

How we work

Set the standard, achieve together, and do the right thing are our core values that guide everything that we do. They’re more than words. We live and breathe them everyday.

We set the standard

We strive to be the benchmark for quality and performance. We don’t claim to be perfect but we are committed to learning every day. We are not just participants in the open data revolution, but leaders who shape its future.

We win together

Our greatest achievements come when we work as one; sharing ideas and expertise to make amazing things happen.

We do the right thing

This isn’t just a statement; it’s a commitment that defines who we are and how we operate. We do the right thing: even when its hard, even when its never been done before, even when no-one is watching.

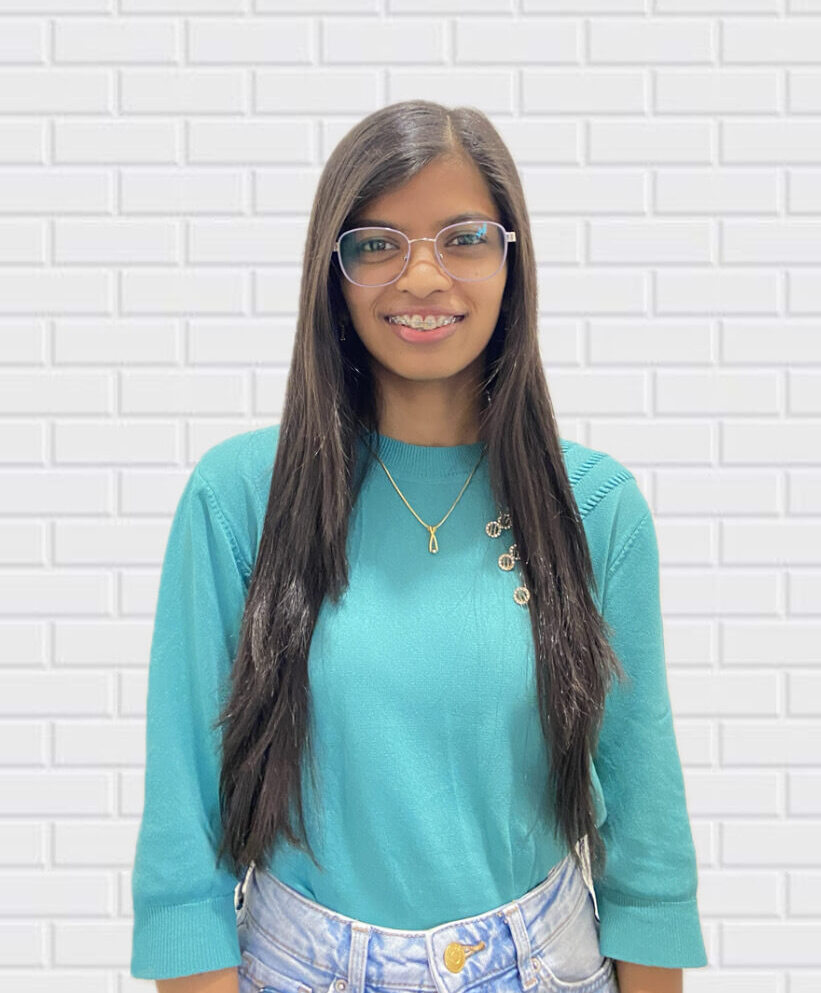

Powered by our global team

Our diverse and global team is at the heart of our ongoing success and the growth of Ozone API.

Join the Team

Ozone API is an active contributing member of the following standard bodies and trade associations: