96% of houses in Sweden have internet access, and 79% of Swedish mobile phones are smartphones. The proportion of 14–76-year-olds using digital banking is 84% in Sweden. Additionally, Sweden ranks third in the integration of digital technologies and ninth in digital public services among EU countries in the Digital Economy and Society Index (DESI) 2022.

Sweden

Open Banking

Open Finance

Sweden falls under the PSD2 legislation and has adopted Berlin Group’s NextGenPSD2 standard. PSD2 is a European Directive that regulates electronic payment services and was implemented in all EEA countries in 2016 and went live in September 2019. Finanstilsynet is the financial authority in Sweden.

In their European Open Banking league, Yapily ranked Sweden 3rd out of 18 countries due to good regulatory supervision with some guidance provided around Open Banking implementation. Sweden’s highly developed digital infrastructures and collaborative approach to cross-border payments drive Open Banking maturity in the region.

However, there is no independent implementation body, such as OBIE (The Open Banking Implementation Entity) in the UK, to help centralise standardisation and drive technical standards. According to Yapily, Sweden should continue to focus on standardising APIs and improving bank uptimes to move up the table, with UX flows and API quality continuing to differ per bank.

The EU Commission has announced its intention to adopt an Open Finance regulatory framework.

There is already robust culture of interoperability between the authentication solutions in the Nordic Countries, which consist of Denmark, Finland, Iceland, Norway and Sweden. The P27 initiative is expected to increase interoperability, and efficiency and save processing time for cross-border payments.

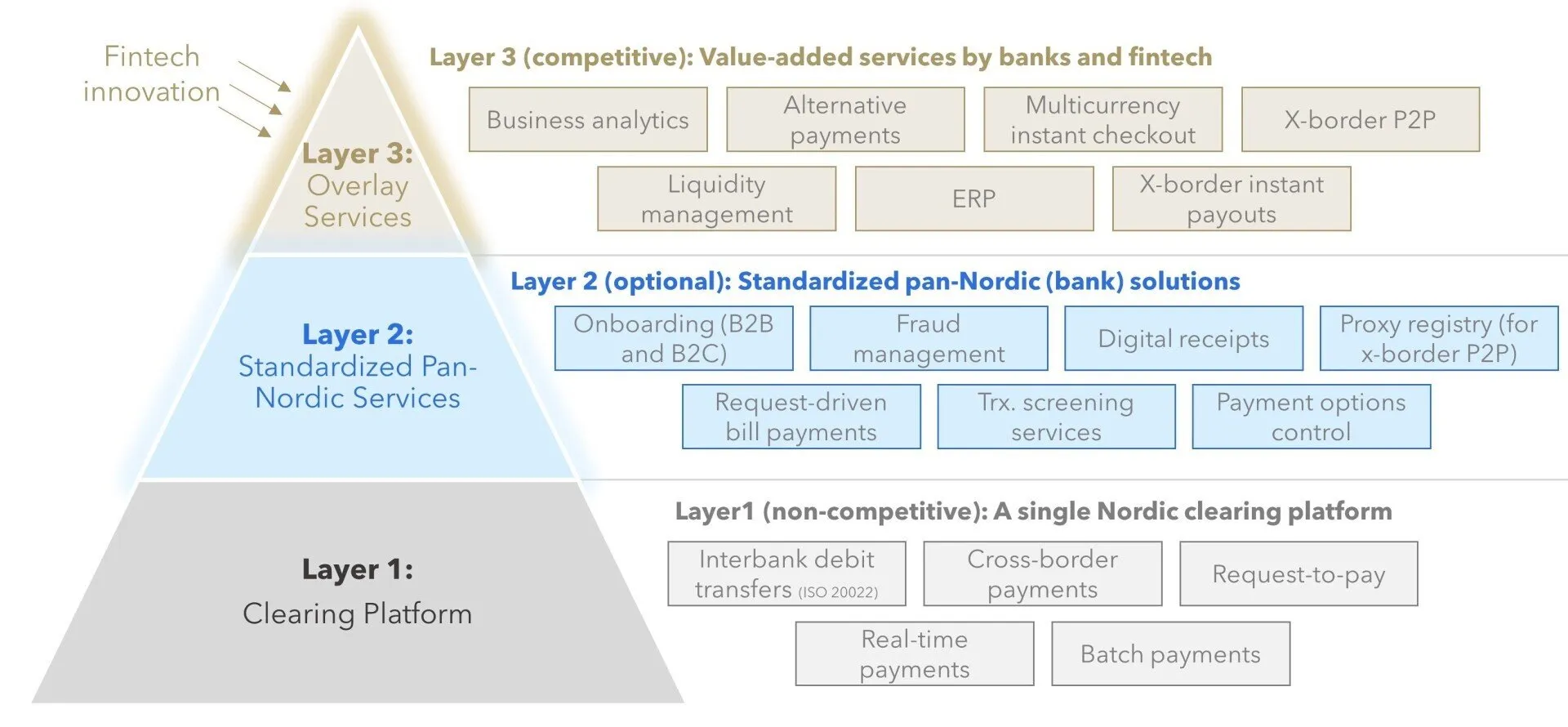

Denmark, Finland and Sweden are working together towards the Nordic collaborative models and P27 initiative, which include Open Banking to deliver a cross-country system and to establish a common clearing platform for payments in DKK, EUR and SEK. While Norway had been a driving force behind P27 in its first year, it stepped back from its involvement in layer one services, consisting of interbank debit transfers, cross-border payments, requests to pay, real-time payments and batch payments (see Figure 1). However, Norway is expected to join the initiative again soon, as the P27 banks have a large market share in the country. The P27 initiative started in 2017 as a joint Nordic bank project. In May 2019, an interim company was established to implement the initiative. In June 2019, an agreement was signed with Mastercard to operate the payments platform. The aim of the initiative is to create one common state of the art payment platform for the Nordic countries.

The next step for P27 is to obtain the necessary clearing licence and merger filing approvals, as well as continue to develop the clearing platform together with Mastercard. The ambition for the company is to go live with the first transactions in 2022.

According to The Global Findex Database, 100% of Swedish adults had bank accounts in 2021. Swedish consumers are particularly interested in the benefits Open Banking payment initiation services can provide. In a recent study researching the Open Banking adoption among consumers, 35.2% of Swedish consumers were interested in receiving intelligent assistance to manage payments, while 30.8% were interested in having their data used to develop convenient new payment methods. In addition, 30% were interested in their financial data being used to offer a better range or better quality of services.

Sweden has good regulatory supervision with some guidance provided around Open Banking implementation. However, according to Yapily, an OBIE-like body would help centralise standardisation and drive technical standards while adding a lot of value to the ecosystem as it would help clarify any remaining issues around the implementation of Open Banking and how the industry could address more use cases.

According to Fintech Global’s research, in 2020, Nordic Fintech companies attracted $1.58bn investment, despite the coronavirus crisis making some investors hesitant to invest.

According to Nordigen, there are 125 licenced Account Information Services (AIS) and 105 passported Third Party Providers (TPPs), according to the Mastercard report in Sweden.

Denmark, Finland and Sweden are working together towards the Nordic collaborative models and P27 initiative, which include Open Banking to deliver a cross-country system and to establish a common clearing platform for payments in DKK, EUR and SEK. While Norway had been a driving force behind P27 in its first year, it stepped back from its involvement in layer one services. However, Norway is expected to join the initiative again soon, as the P27 banks have a large market share in the country. The P27 initiative started in 2017 as a joint Nordic bank project. In May 2019, an interim company was established to implement the initiative. In June 2019, an agreement was signed with Mastercard to operate the payments platform. The aim of the initiative is to create one common state of the art payment platform for the Nordic countries. The next step for P27 is to obtain the necessary clearing licence and merger filing approvals, as well as continue to develop the clearing platform together with Mastercard. The ambition for the company is to go live with the first transactions in 2022.

Sweden ranks fourth in human capital among EU countries in the Digital Economy and Society Index (DESI) 2021. The human capital measures digital skills, the proportion of employed people working as ICT specialists, female ICT specialists, and enterprises offering ICT training.

Sweden has a Financial Innovation Centre, which works to provide information, offer guidance and maintain a dialogue between firms that want to provide innovative products and services. The Innovation Centre functions as a catalyst in Financial Innovation’s (FI) internal discussion about innovation and participates actively in several international task groups.

Sweden has adopted the Berlin Group’s NextGenPSD2 technical standard.