5 Observations from Supporting the Major Global Open Banking Standards

At Ozone API our mission is to help banks and financial institutions deliver high performing open APIs, so they can meet regulatory requirements and drive their strategies for creating revenue through value adding and premium APIs.

Our background has involved creating a number of the leading global open banking standards so we have a fairly unique insight. But in building our platform to support all global standards we have made some interesting observations.

With markets around the world delivering open banking and open finance, we are seeing more standards and variants of standards emerging.

This is usually for good reason as each market may be doing it with slightly different objectives in mind, for example to tackle financial inclusion, drive investment and growth, while accelerating innovation in financial services.

These different drivers may result in varied frameworks focusing on different key enabling use cases. And this is leading to new variances of these standards.

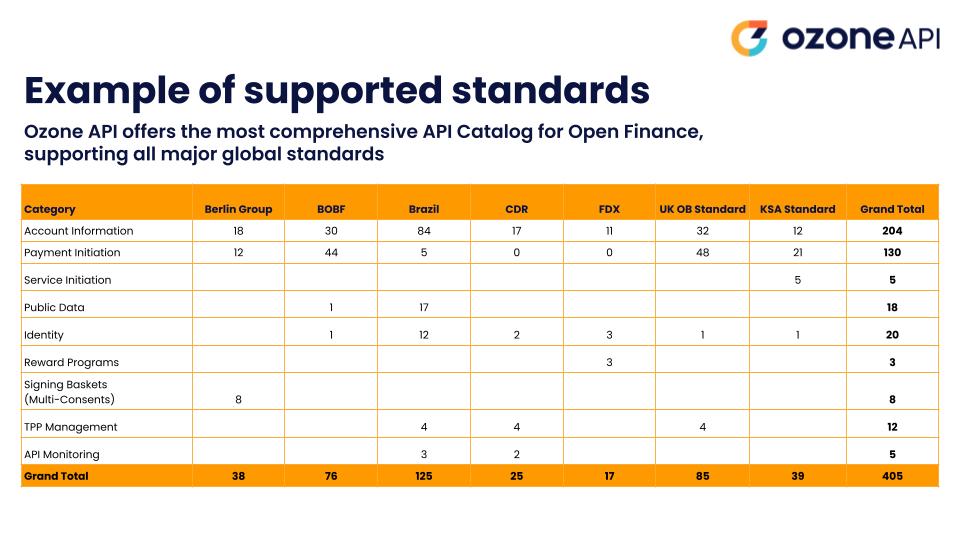

As mentioned, this can be a good thing, accelerating the innovation around standards and creating new capabilities (see the chart below). But it certainly increases the complexity for banks with multiple global standards that are also continually changing. Learn more by exploring The Global Open Data Tracker to see the evolving ecosystem of global open finance standards.

Whilst it’s true that the standards landscape is seeing fragmentation and different variances, it’s also true that a lot of the core foundations are similar, creating a good path for interoperability.

For example:

Open banking is definitely not a case of “build it once and you’re done”. Most of the standards continue to evolve as the regulatory frameworks and market demands evolve. This results in regular updates to standards, bringing improvements and new functionality.

In some markets that may happen in fairly structured major and minor releases a few times a year. In other markets (Brazil being a case in point) change is almost constant with an ongoing cycle of updates and re-certification across open finance and open insurance every few weeks.

Doing it well means staying at the sharp end of the spear and constantly evolving to keep up with the evolution (and sometimes revolution) in the standards space.

We’re helping to power open banking for many banks around the world from Latam to Australia and everywhere in between. In doing so we’ve built our platform so we can simply and rapidly add any new global standard and keep it up to date.

When we look at the range of standards it’s remarkable the amount of capability and extent of APIs that are enabled.

The chart below compares just some of the standards that we are supporting on behalf of our banks and partners. And the numbers continue to increase all the time.

The key discussion we have with banks around the world is how they can use open APIs to really create value and deliver better financial experience for their customers. As we look at the breadth of capabilities across the standards it already creates a rich menu of capabilities.

We’re working with banks and financial institutions around the world to help them take advantage of the capabilities and to build new ones. Typically in areas like:

This is heading in one direction, and we’ll see the global menu of standards cater to the needs of most banks in the near future.

For us to ensure we can enable our customers and partners around the world to deliver the most comprehensive open banking strategies, our mission is to continue to both shape and support the wide array of global standards.

In doing so we take away the complexity AND deliver a much more future proofed platform for any bank or financial institution.

One thing is certain, the landscape will continue to become both more complex and more enabling.

Get in touch to speak to one of our open finance experts.

Huw Davies, CEO and Co-Founder of Ozone API shares three predictions for what's coming in open banking and open finance over the next twelve months. Find out what's to come in 2026.

How can banks monetise open banking APIs? Ozone API CEO & Co-Founder explores 3 commercial models to turn APIs into profit.

Cómo Brasil construyó un ecosistema financiero abierto integral en 5 años con más de 700 participantes y más de 60 millones de usuarios, pasando de seguidor a líder mundial.