Open banking really came to light when the second Payment Services Directive (PSD2) was released in 2018. It was predicted then to hold immense potential for businesses and consumers, and it has certainly performed. There’s also no sign of the industry slowing down any time soon; a report by Allied Market Research predicted the open banking market value will reach over $43 billion by 2026, with a 24.4% growth in consumers using it.

It has been out with the screen scraping and sharing of on-line banking login credentials, and in with secure straightforward API’s for a while now, but what does open banking actually mean and what is it trying to achieve? Is it even safe?

Throughout this introduction to open banking we cover those questions as well as look at the key components of open banking, its benefits and what the future holds for the industry.

What is Open Banking?

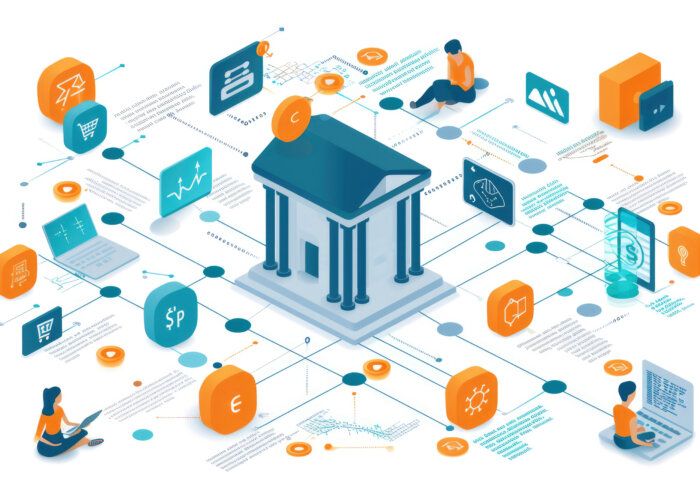

Firstly, the basics. Open banking allows trusted third parties to access financial information from banks and other financial institutions in order to provide services to customers, but only with the customers explicit consent.

This gives customers more control over their data so it can be used securely to help them move, manage and get more out of their money in a simple way.

How does open banking work?

Open banking is in practice when access to financial data is granted through the use of API’s to third parties. Third parties typically are looking to provide a service or an app to the banks customers that makes use of the shared financial data.

The data that can be shared includes the account holders information, such as balances, transactions and account history. Transaction data, such as date, time and merchant name. And information that helps determine a customer’s income, costs, loan repayment history and spending power (all things that help lenders make better decisions).

Open Banking is being adopted by 68 countries globally, and there are of course regulations around the sharing of customer data with third party service providers, which these companies have to comply with.

In addition there are standards which determine how the APIs which banks and Financial Institutions expose should be designed. In the UK there is the UK open banking standards, in Australia there is the Consumer Data Standard, and in New Zealand they have to comply with the Payments NZ standard. Our Global Open Data Tracker allows you to view and compare all major standards around the world.

Banking APIs

You’ve probably used services enabled by APIs when doing your banking, and not even realised it.

If someone was using a finance management app to track spending habits across multiple bank accounts, this app would utilise open banking APIs to securely access the account information from different banks and aggregate it into one platform.

The APIs can and are being used to facilitate data exchanges between banks and third parties, and there are 4 main types: Data APIs, Product APIs, Payment initiation APIs and Service initiation APIs. But what do each of them enable?

Data (or account information) APIs

Data APIs provide read-only access to account information such as balances and transaction history.

Product APIs

Product APIs enable banks and financial institutions to list more static information such as financial products, rates and terms, ATM locations etc. They’re often used for comparison websites or marketplaces.

Payment initiation APIs

Payment initiation APIs allow a payment to be initiated from the customers bank account to a defined destination account, for example to sweep funds between accounts, to pay a bill or to set up future and recurring payments.

Service initiation APIs

Service initiation APIs enable a process or service to be initiated such as applying for a new account, requesting an increased credit line or changing details.

How does open banking differ from traditional banking models?

Traditionally customers have to go to their bank (eg the branch or mobile app) to access their account and manage their money.

With open banking customers have more flexibility, for example to use specialist tools to see and manage their money across all accounts, share information to get better deals and to access services in more ways. Ultimately driving more innovation and better outcomes.

What’s the difference between open banking and open finance?

Open finance is a broader concept. While open banking primarily focuses on granting third-party access to bank account data and services through APIs, open finance encompasses a wider range of financial services and products.

Open finance aims to create a more interconnected and accessible financial ecosystem by facilitating the exchange of data and services among various financial institutions, fintech companies, and other third-party providers. This includes not only banking data but also data related to investments, insurance, lending, payments, and more.

Why is open banking happening?

In a number of markets traditional banks have sometimes been accused of not competing hard enough to offer innovative products and attractive rates to consumers or businesses. As a consequence, some regulators have implemented open banking to increase competition and drive more innovation.

In other markets we’re seeing open banking and open finance being driven as a catalyst for both economic and societal transformation. The implementation has been seen to fire the starting gun for increased investment into an economy, the creation of new companies and jobs as well as laying the foundations to tackle financial inclusion barriers and increase access to credit.

It also aims to empower consumers with more control over their financial data and improve their ability to find better deals, manage their finances more effectively, and access tailored financial products and services. Ultimately, it seeks to drive innovation, improve customer experience, and foster greater efficiency in the financial sector.

It also creates a more secure foundation for data sharing and as a result reduces the risks associated with practices such as screen scraping. It prioritises the security and privacy of consumers’ financial information through a combination of technological, regulatory, and procedural safeguards.

Benefits of open banking

It is becoming increasingly clear that open banking brings benefits to all parts of the financial services ecosystem. But for banks and financial institutions it should be game changing.

Financial institutions will see a positive impact as they will be able to improve customer service, access new markets and increase efficiency. But those aren’t the only benefits.

Through exposing great APIs banks can ensure their products and services can be embedded in third party digital journeys, so they are in the right place at the right time for new and existing customers. Essentially creating a next generation channel to market.

They will be able to offer customers a broader range of products and services by integrating with third-party providers, which can lead to more personalised offerings and a better overall customer experience.

By leveraging open banking APIs, financial institutions can also provide a broader and richer set of experiences for their customers in their existing channels. Allowing them to see all of their accounts in their mobile app or to streamline their processes and reduce operational costs. For example, they can automate tasks such as account aggregation, transaction categorisation, and credit risk assessment.

Standards often include strict security and compliance requirements, which can help financial institutions improve their cybersecurity posture and ensure regulatory compliance.

In summary, implementing an open banking API, such as Ozone API’s technology, can lead to the development of new financial products, improved customer experiences, offer greater transparency and security, and save businesses time and money.

Open banking use cases

Open banking can be used to make financial services more useful for individuals and business as it opens up the door to better products and offerings, and will have positive implications for various user groups across the financial ecosystem:

Individual Customers

It empowers individual customers by providing them with greater control and access to their financial data. They can securely share their banking information with third-party providers to access personalised financial services, budgeting apps, and better loan rates.

Financial Institutions

Traditional banks face both challenges and opportunities with open banking. While it may introduce competition from fintech startups, it also offers opportunities to collaborate with third-party providers, distribute products in new and innovative ways, improve customer experiences and create new revenue streams.

Fintech Companies

It serves as a catalyst for fintech innovation, enabling startups to develop innovative products and services that leverage banking data. Fintech companies can offer tailored financial solutions, such as budgeting tools, investment platforms, and lending services, by accessing customer data through APIs.

Small and Midsize Businesses

It facilitates easier access to financial services for small and midsize businesses (SMBs). They can leverage banking data to streamline accounting processes, access financing options, and make more informed financial decisions, ultimately driving business growth.

E-commerce Companies

Open banking offers e-Commerce companies opportunities to enhance payment processes, improve security, and offer more personalised shopping experiences. By integrating with banking APIs, they can streamline checkout processes, reduce transaction costs, and mitigate fraud risks.

Accounting Platforms

Its integration enables accounting platforms to automate data entry processes, reconcile transactions in real-time, and provide businesses with accurate financial insights. This streamlines accounting tasks, reduces errors, and enhances financial reporting capabilities.

Credit and Lending Institutions

It facilitates more accurate credit risk assessment and enables lenders to offer personalised loan products based on borrowers’ financial data. This improves access to credit for consumers and businesses, while also reducing the risk of default for lenders.

As you can see, there are various use cases for open banking including across a whole host of user groups. Ozone API is a specialist fintech in the open banking space offering API solutions to help banks and financial institutions deliver high performing and standards compliant open APIs, here are some of Ozone API’s case studies.

Is Open Banking Safe? Regulatory Framework for Open Banking

Yes, open banking is safe. There’s typically a regulatory framework for countries that have adopted open banking to ensure consumer protection and data security. The addition of open banking standards which incorporate strong levels of security and facilitate granular consent and the establishment of trust and certainty between all parties.

Open data is creating an unprecedented opportunity to drive innovation on a global scale and safely unlock the power of financial data. But the global landscape is complex. Ozone API in partnership with Smart Data Foundry, has developed tools to make it easier to understand what is happening where.

Our standards library compares global open banking and open finance standards and regulations, and our innovation atlas offers an overview of open finance progress and status around the world.

What does the future hold for open banking?

The deployment of open banking holds tremendous potential for further transformation and innovation within the financial industry, tech firms, and beyond.

We’ve seen the success it has brought, but we can’t deny that some countries aren’t as quick as others in developing and deploying the technology. As these challenges are addressed and the benefits of open banking become more apparent, its adoption is expected to accelerate in the coming years.

Could APIs such as Ozone API be the way forward to speed up the process for everyone in the ecosystem?

Ozone API helping to shape the future

Ozone API is a Fintech in the open banking space. We help banks deliver APIs to both comply and also monetise open banking, and we help central banks and market enablers deliver the foundations for a successful ecosystem

The Ozone API is a SaaS platform that delivers open banking in a box, in line with any global standard to ensure compliance with regulations.

Our technology removes the complexity and cost of developing and maintaining APIs to continuously evolving global standards, enables rapid compliance with open banking regulations, and provides the tools to deliver value adding and commercial APIs to grow revenues.

Get in touch to find out how we can help you on your open banking journey.