Open Finance is a financial ecosystem that enables customers to share their financial data securely and use the data to access financial products and services. This financial model has gained significant momentum in the last few years and has the potential to transform the financial landscape of Latin America.

In this report, we will share the current state of Open Finance in Latin America in 2023.

The Latin American region has been an early adopter of Open Finance. In 2023, the market has grown significantly, with several players entering the market. Open banking, which is the foundation of Open Finance, is becoming a reality in several countries, including Brazil, Mexico, and Colombia.

The adoption of Open Banking is increasing competition, reducing barriers to entry for new players, and enabling customers to access a wider range of financial products and services.

Brazil

Brazil has been at the forefront of Open Banking adoption in Latin America, with the Central Bank of Brazil introducing regulations to enable Open Banking in February 2021. The market has since grown rapidly, with several fintechs and financial institutions adopting Open Banking. In 2023, Open Finance in Brazil is evolving beyond Open Banking, with several companies offering aggregation and personal financial management services and the services expanding into other areas, such as Open Insurance, with the first phases being implemented in the next months.

Mexico

Mexico has also made significant progress in adopting Open Banking. In 2020, the Bank of Mexico introduced regulations to enable Open Banking, with the adoption by some financial institutions but with slow steps in the implementation roadmap. In 2023, Open Finance in Mexico is still in its early stages, with several fintechs entering the market and offering innovative financial products and services.

Colombia

Colombia has also adopted Open Banking, with the country’s financial regulator introducing regulations in 2021. The major players in the market are now working on their Open Banking platforms and we may expect a huge growth in the market, with several fintechs and financial institutions adopting Open Banking and offering innovative financial products and services.

Chile

In Chile, Open Banking is still in its early stages, with the country’s financial regulator, the Superintendency of Banks and Financial Institutions (SBIF), introducing a draft regulation in 2021. The regulation is expected to be completed and come into effect in 2024, and several fintechs and financial institutions are already preparing to adopt Open Banking.

Peru

Peru has also started to analyse Open Banking, with the country’s financial regulator, the Superintendency of Banking, Insurance and Private Pension Fund Administrators (SBS), starting to work on the regulations in 2022, after the law proposal 1584/2021-CR was submitted in the congress in March 2022. Local players (Peruvian Banking Association (ASBANC), the Central Reserve Bank of Peru and state agencies) are sharing their reviews on the benefits of Open Banking and we expect advances in the regulatory release by the end of 2023.

Republica Dominicana

In Republica Dominicana, the Central Bank is working with the Banks Association (ABA) to progress with the regulation’s definition started in 2021 to enable Open Banking. All the banks are considering Open Finance opportunities and how to enable new services for the local market.

Guatemala

In Guatemala, the financial regulator, the Superintendency of Banks, has not yet introduced regulations to enable Open Banking. However, several fintechs and financial institutions are already considering innovative financial products and services, and there is an increasing demand for Open Banking in the country.

Argentina

In Argentina, the central bank is paving the way for open banking, introducing new regulations and initiatives to encourage digital payments and enable interoperability. The regulations are being discussed by several players, benchmarking with other markets from Europe and Latin America.

Uruguay

Uruguay has not approved any law or regulation related to Open Banking yet. However, since 2021, the Central Bank of Uruguay, convened policy-makers, IT companies, startups, fintech companies, academics, traditional large banks, and other stakeholders of the wider financial services sector to participate in different working groups to share perspectives and insights on where they think Open Banking is heading. Although the regulation process itself has not started, all stakeholders are very enthusiastic about a potential Open Banking initiative and the advances in the year that will soon end have been significant.

Ecuador

In Ecuador, the financial regulator, the Superintendency of Banks and Insurance, has not yet introduced regulations to enable Open Banking. However, several fintechs and financial institutions are already offering innovative financial products and services and the market is pushing the adoption of new financial services based on Open Banking foundations.

What are the Challenges?

Despite the progress made in adopting Open Finance in Latin America, several challenges still exist. One significant challenge is the lack of awareness among customers about the benefits of Open Finance. Many customers are still hesitant to share their financial data, and there is a need for more education and awareness campaigns to increase customer trust and confidence.

We believe this is mainly due to the lack of appealing end user services which will really offer an improved user experience. There are several developments on going but none has reached yet the level of maturity to unlock the full potential of the Open Finance opportunities.

Another challenge is the lack of standardisation in Open Finance. Different countries have adopted different regulations and standards, leading to fragmentation of the market.

There is a need for more collaboration and standardisation across countries to enable interoperability and promote competition. This will also enable service providers to easily promote their services in several countries with a low effort to make the integration compatible with the local Open Finance regulations.

What are the benefits?

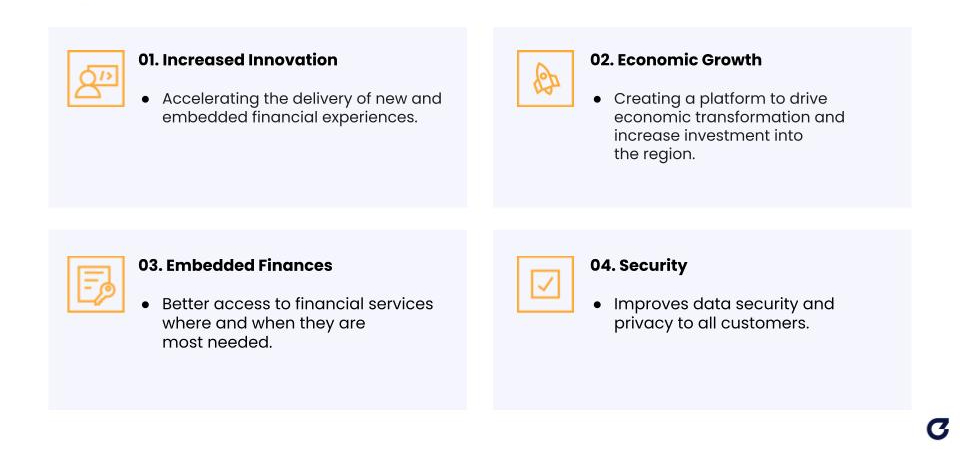

Open Finance has the potential to transform the financial landscape of Latin America, and the market has made significant progress in the last few years. Financial inclusion and higher competition will unlock huge progress for end users, especially with the embedded finances approach, where financial services will be seamlessly offered where and when they are most needed, with a completely new user experience when compared to current financial services offered by traditional banks.

However, several challenges still exist and addressing these challenges will be critical in ensuring the growth and success of Open Finance in Latin America in the coming years.

We’re already powering open APIs for a large number of banks in the LATam region and are ready to help through our local presence and with a platform already conformant to local standards. Find out more about our global coverage.

View the full slide deck below: